NY NYS-45-MN 2005-2026 free printable template

Show details

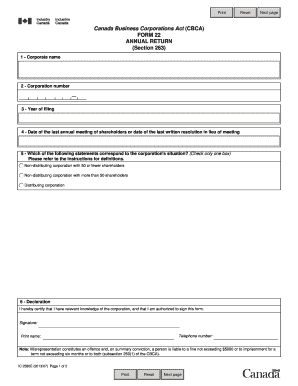

NYS-45-MN 1/05 Reference these numbers in all correspondence Quarterly Combined Withholding Wage Reporting And Unemployment Insurance Return Mark an X in only one box to indicate the quarter a separate return must be completed for each quarter and enter the tax year. 24. Did you sell or transfer all or part of your business If Yes indicate if sale or transfer was in Yes Whole No Part Note Complete Form DTF-95 Business Tax Account Update to report...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ny45 form

Edit your nys 45 forms form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ny 45 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit nys 45 online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form nys 45. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nys 45 fillable form

How to fill out NY NYS-45-MN

01

Gather necessary information such as your employer identification number (EIN) and employee details.

02

Download the NYS-45-MN form from the New York State Department of Taxation and Finance website.

03

Complete the designated sections: Report all wages paid, taxes withheld, and any adjustments.

04

Ensure you have filled out your contact information and relevant tax period.

05

Sign and date the form if submitting by mail.

06

Submit the completed form either electronically or by mail to the appropriate state office.

Who needs NY NYS-45-MN?

01

Employers in New York State who are required to report unemployment insurance contributions and wages paid to employees.

Fill

nys 45 pdf

: Try Risk Free

People Also Ask about nys form 45

What is a NYS-45?

NYS-45, Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return. All employers required to withhold tax from wages must file Form NYS-45, Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return, each calendar quarter.

Where do I find my NYS-45?

You may also contact the NYS Department of Taxation and Finance at (518) 457-5431 for a paper copy of the form.

Who is required to file NYS-45?

All employers required to withhold tax from wages must file Form NYS-45, Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return, each calendar quarter. If you withhold less than $700 during a calendar quarter, remit taxes withheld with your quarterly return, Form NYS-45.

What is NYS-45 from QB?

The Form NYS-45 in QuickBooks is used to file and pay the withholding payment in New York. These payments are […] The Form NYS-45 in QuickBooks is used to file and pay the withholding payment in New York. These payments are done separately if you owe it then you have to pay it using the Form NYS-45 in QuickBooks.

What is the difference between NYS 1 and NYS-45?

Form NYS-1, Return of Tax Withheld, must be filed and the total tax withheld paid after each payroll that caused the total accumulated withholding tax to equal or exceed $700. If you withhold less than $700 during a calendar quarter, remit the taxes withheld with your quarterly return, Form NYS-45.

How do I get NYS-45?

You may also contact the NYS Department of Taxation and Finance at (518) 457-5431 for a paper copy of the form.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get nys 45 form pdf?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific form 45 and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I create an electronic signature for the new york state form 45 in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Can I create an eSignature for the nys45 form in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your nys 45 x form right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is NY NYS-45-MN?

NY NYS-45-MN is a form used by employers in New York State to report employee wages and withholding tax for New York's Metropolitan Commuter Transportation Mobility Tax (MCTMT).

Who is required to file NY NYS-45-MN?

Employers who are engaged in business in New York State and have employees whose wages are subject to the Metropolitan Commuter Transportation Mobility Tax must file the NY NYS-45-MN.

How to fill out NY NYS-45-MN?

To fill out the NY NYS-45-MN, employers need to provide their business information, the total amount of wages paid to employees subject to MCTMT, and the amount of tax withheld. Detailed instructions for each section can be found on the form itself or in the accompanying guidelines.

What is the purpose of NY NYS-45-MN?

The purpose of NY NYS-45-MN is to help the New York State Department of Taxation and Finance collect taxes related to the Metropolitan Commuter Transportation Mobility Tax, which supports regional transportation projects and services.

What information must be reported on NY NYS-45-MN?

On the NY NYS-45-MN, employers must report employee wages subject to MCTMT, the amount of MCTMT withheld, the total number of employees, and relevant identification information for the employer.

Fill out your NY NYS-45-MN online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mv 45 Form Ny is not the form you're looking for?Search for another form here.

Keywords relevant to how to file nys 45 online

Related to nys 45 online

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.